Banking is made simple, convenient, and secure with our online and mobile banking platform.

Online Banking

- Access to deposit and loan balance information

- Access to a detailed history of your accounts

- View account statements

- Transfer money between accounts or schedule loan payments

- Download transactions to spreadsheet or word-processing packages

- Contact the bank via the Secure Message feature

- View current deposit interest rates

- Change address

- Order checks

- Stop payment on checks

- Activate, reorder, or deactivate (report as lost/stolen) VISA debit cards

Mobile Banking

- Optional Touch and Face ID sign-in

- View balances, transfer money between accounts, schedule loan payments, and pay bills

- Person-to-person payments

- Mobile Deposit of checks

- quickly, accurately, and securely deposit checks using your camera-enabled smartphone or tablet

Bill Pay

- Pay bills now or schedule future or recurring payments

- Have complete online access to bill payment history

- Add or delete payees online

- A confirmation number is provided at the end of each transaction as your receipt

Pay a Bill or Bill Pay allows you to track check payments, view check images and payment history through the Bill Pay portal. You can also set up text alerts and payment reminders. Using the E-Bill feature provided allows you to receive and pay bills electronically through your Bill Pay account.

Pay a Person allows you to send money to a recipient directly. Simply set up the person you want to pay with a code word and the system handles the rest, delivering funds within 1-2 business days, no routing or account number needed.

Electronic Statements and Notices

Secure Message

Remote Deposit

Remote Deposit, sometimes referred to as Mobile Deposit, is a service that allows you to take a picture of a check using your smartphone and submit it for deposit into your selected account. It is only available on Mobile Banking.

Things to know about Remote Deposit:

- Your account must be enrolled in Remote Deposit before you can make a deposit.

- Approval of Remote Deposit can take 1-3 days.

- Limits for Remote Deposit are $500 per day and $2500 per month. A maximum deposit of $500 can be made for a single deposit.

- A very specific endorsement is required on all checks that are submitted for Remote Deposit.

- Remote Deposit items are posted in 1-3 days of deposit.

- If there is an issue you will be contacted at the cell phone number that is listed on file.

Insights/Budget Tracker

If you need a tool to track all your spending and meet your financial goals, we have just the thing for you. Through Insights you can take control of your finances by adding all your accounts, not just the ones at HSB. Insights allows you to create budgets and goals, monitor your cash flow and net worth, and track all spending by category.

Security

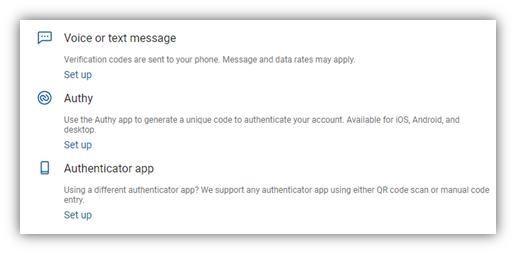

Securing your accounts and information is a top priority at Hebron Savings Bank. When you enroll in Online Banking, you will be asked to set up Two-Factor Authentication. You can choose to use a voice or text message, the Authy App, or an Authenticator App of your choosing, as long as it is supported by a QR code or manual code entry. You can also update this at any time using the Personal Settings option in Online Banking.

Community Involvement

See how we are committed to making a positive impact in our community!